rsu tax rate california

If you also paid tax to Massachusetts. Web Tax rate.

Restricted Stock Unit Rsu Taxation Stay On Top Of Your Tax Withholding Lifesighted

It is taxed in the same way as most cash bonuses.

. Web Carol Nachbaur April 29 2022. Web Also restricted stock units are subject to withholding for social security taxes and medicare taxes. Web How is RSU state tax calculated.

Web California City County Sales Use Tax Rates effective October 1 2022 These rates may be outdated. Vesting after Medicare Surtax max. With an all-in tax rate of 15 you only.

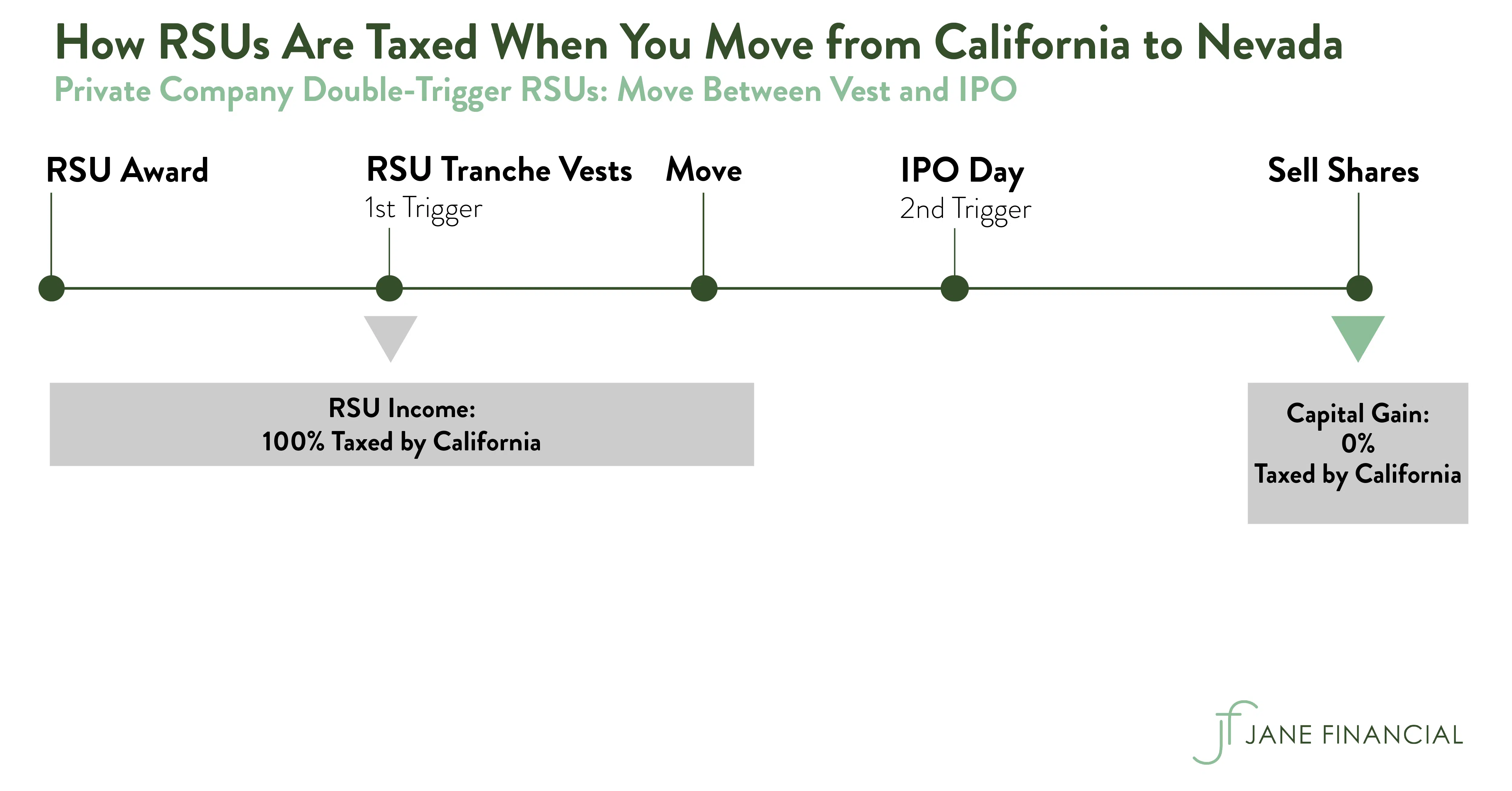

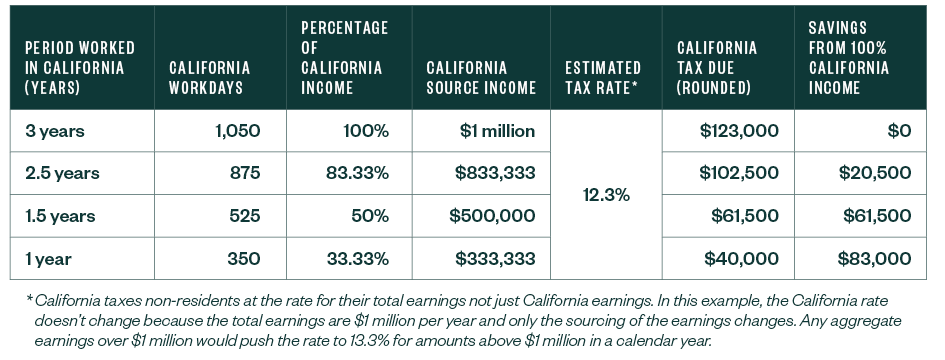

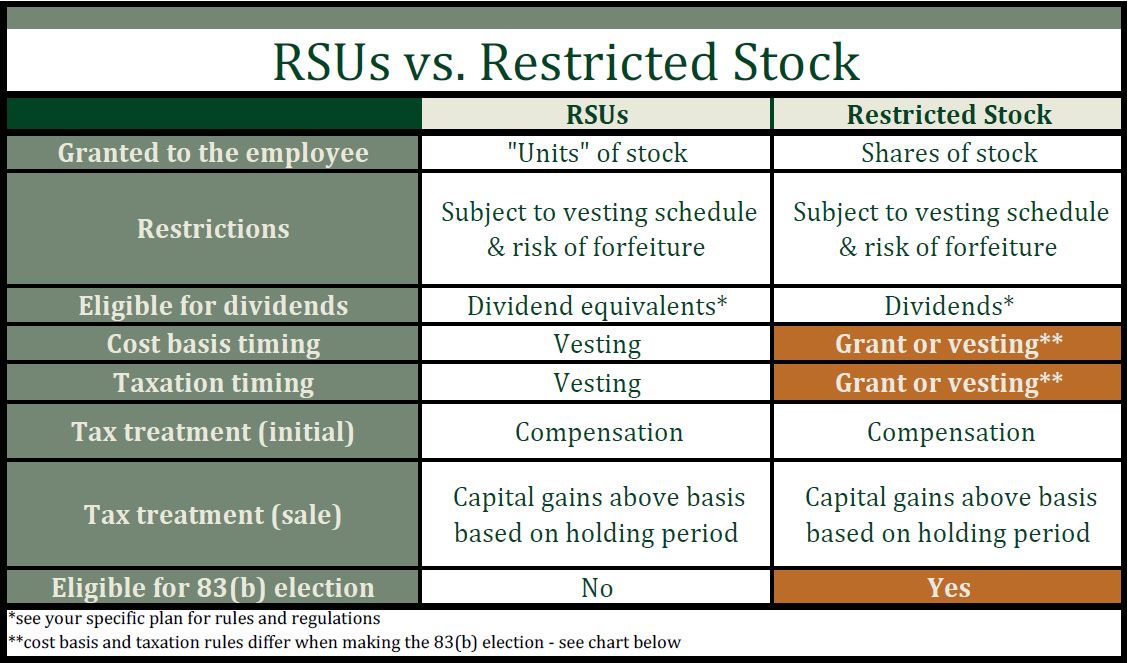

As your actual tax rate increases including FICA state taxes etc it becomes more expensive to vest into RSUs. Web For restricted stock units RSUs California has a formula for determining how much of the income from your RSUs is California income. They are not stock until they vest.

When the units vest the value on the date of vest is supplemental ordinary income. Web Taxes on Restricted Stock Units. If you are an.

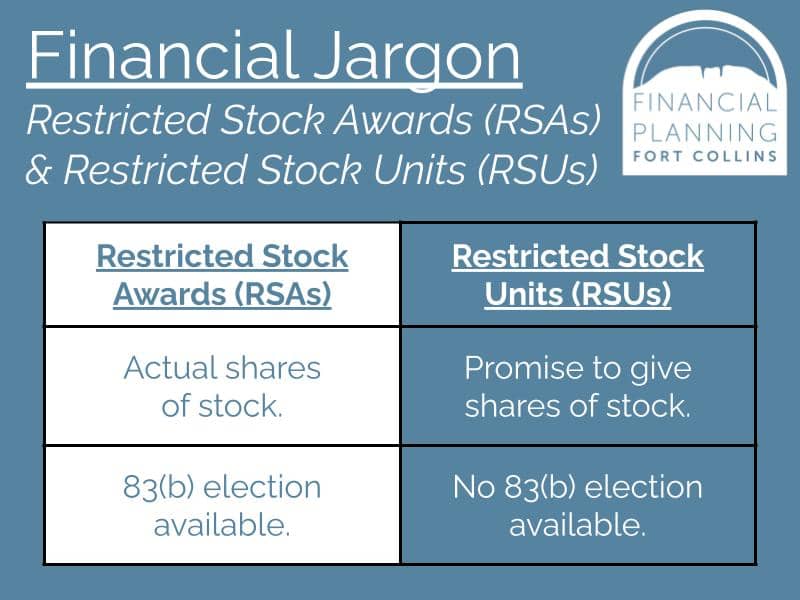

Restricted Stock Units do not qualify for 83b election only real stock can qualify. Different taxes apply based on the RSU lifecycle. If you were a California state resident on the day that the RSUs were granted you pay California state taxes on the day that they vest based on the amount.

RSUs are taxed at the ordinary income rate and tax liability is triggered once they vest. If youre in the 25 bracket and get 10k of RSUs youd pay about 25 federal tax and 9 state tax. Many employees receive restricted stock units RSUs as a part of their compensation particularly in the tech industry.

California taxation of RSU income happens in two steps. Web Avoid tax surprises that arise from restricted stock units RSUs by being proactive with your RSU tax withholding and estimated tax payments mid-year. This will result in another 765 in tax liability.

Web Answer 1 of 4. Your company is required to. In addition the RSUs.

If you then hold the vested shares for over one year before selling them then any additional. Lets consider this example. California taxes vested RSUs as income.

Its important to remember. In all states RSUs are taxed as regular income based on value at time of vesting. Web Answer 1 of 2.

Vesting after Social Security max. Web California taxes the resulting ordinary income and capital gain because you are a California resident when the stock is sold. Web How Are Restricted Stock Units RSUs Taxed.

Web Theyre taxed as ordinary income - so its based on your marginal tax bracket. Vesting after making over 137700. This is different from.

For a list of your current and historical rates go to the. Web I have a question on how RSUs vest for non-residents who become temporary residents of California.

Restricted Stock Unit Rsu How It Works And Pros And Cons

The Mystockoptions Blog Tax Planning

Restricted Stock Units Rsus Facts

Restricted Stock Units Jane Financial

Thinking About Rsu Vesting In Terms Of A Cash Bonus San Francisco Ca Comprehensive Financial Planning

What S The Difference Between Restricted Stock Units Rsus Restricted Stock Awards Rsas Sensible Financial Planning

What Is Going To Happen To Shutterfly Rsus Graystone Advisor

How To Calculate Iso Alternative Minimum Tax Amt 2021

All About Rsus And Rsas Too Financial Planning Fort Collins

How Do I Diversify My Rsus Executive Benefit Solutions

How State Residency Affects Deferred Compensation

Rsus Vs Stock Options What S The Difference Carta

Tax Accounting And Startups Rsus Restricted Stock Units

How Do Restricted Stock Units Rsus Work Brenton Harrison

How Do Restricted Stock Units Rsus Work Brenton Harrison

Stock Options Rsus And Taxes Part 1 Wealthfront

California Income Tax And Residency Part 2 Equity Compensation And Remote Work Parkworth Wealth Management

Navigating Your Equity Based Compensation Restricted Stock Restricted Stock Units Verum Partners