unlevered free cash flow vs free cash flow

Unlevered free cash flow is a theoretical dollar amount that exists on the cash flow statement prior to paying debts expenses interest payments and taxes. Unlevered free cash flow is used in both DCF valuations and debt capacity analysis and represents the total cash generated for both debt and equity holders.

The Ultimate Cash Flow Guide Understand Ebitda Cf Fcf Fcff Cash Flow Statement Cash Flow Financial Statement Analysis

Free cash flow is the cash that a company generates from its normal business operations before interest payments and after subtracting any.

. Levered Free Cash Flow is the amount that is available to the shareholders since all debt obligations have been paid out. Levered free cash flow is the amount of cash left over from the cash generated by the business from its operations after paying its financing costs like interest and principal repayments on its debt. UFCF is the amount of cash a company generates from its operations without accounting for its finance costs such as debt-related payments.

Unlevered free cash flow is the gross free cash flow generated by a company. Requires a multi-step calculation and is used in Discounted Cash Flow. Unlevered Free Cash Flow also known as Free Cash Flow to the Firm or FCFF for short is a theoretical cash flow figure for a business.

Unlevered free cash flow is usually only visible to financial managers and investors rather than to the average consumer. Unlevered free cash flow is the amount of cash a company has prior to making its debt payments. To fully understand and successfully execute the unlevered free cash flow formula its crucial that you have a good grasp of the following definitions.

If the cash flow metric used as the numerator is unlevered free cash flow the corresponding valuation metric in the denominator is enterprise value TEV. Levered free cash flow on the other hand works in favor of the business that didnt borrow any capital and doesnt necessarily show a comparative analysis of each companys ability to generate cash flow on an ongoing basis. Levered cash flow is the amount of free cash available to pay dividends the amount of cash available to equity holders after paying debt.

EBITDA is the common acronym for Earnings Before Interest Taxes Depreciation and Amortization This is a critical piece of the puzzle. Levered Free Cash Flow LFCF includes both interest expenses and debt principle payments. On the other hand if the cash flow metric is levered free cash flow then the matching valuation metric would be the equity value.

FCFE Free Cash Flow to Equity Levered Free Cash Flow LFCF The value of a company if all debt was paid off. Levered cash flow is the amount of cash a business has after it has met its financial obligations. Free cash flow represents the amount of cash that a company has at the end of the day which could theoretically be.

Used to value equity with a Cost of Equity discount rate only if there are no bondholders andor preferred shareholders FCFF Free Cash Flow to Firm Unlevered Free Cash Flow UFCF The value of the entire firm or enterprise. While unlevered free cash flow looks at the funds that are available to all investors levered free cash flow looks for the cash flow that is available to just equity investors. Free Cash Flow to Firm FCFF also referred to as Unlevered Free Cash Flow and Free Cash Flow to Equity FCFE commonly referred to as Levered Free Cash Flow.

It is also thought of as cash flow after a firm has met its financial obligations. There are two types of Free Cash Flows. It is the cash flow available to all equity holders and debtholders after all operating expenses capital expenditures and investments in working capital have been made.

Free cash flow is the amount of cash that a company has generated after adjusting for non-cash expenses changes in working capital and capital expenditures CapEx such as property buildings and other physical assets. Leverage is another name for debt and if cash flows are levered that means they are net of interest payments. Free Cash Flow vs.

Free Cash Flow to the Firm or FCFF also called Unlevered Free Cash Flow. If this isnt clear yet dont worry. Unlevered Free Cash Flow Unlevered Free Cash Flow is a theoretical cash flow figure for a business assuming the company is completely debt free with no interest expense.

Levered Free Cash Flow is considered to be an important metric from the perspective of the investors. Unlevered Free Cash Flow UFCF excludes interest expense and debt principle payments. It is important to understand the difference between FCFF vs FCFE as the discount rate and numerator of valuation multiples Types of Valuation.

Levered free cash flow is the amount of cash a business has after paying debts and other obligations. Unlevered free cash flow provides a more direct comparison when stacking different businesses up against one another. Unlevered free cash flow is the money the business has before paying its financial obligations.

On the other hand unlevered free cash flow UFCF is the sum available before debt payments are made. The difference between UFCF and LFCF is the financial obligations interest and principal. Free Cash Flow vs.

UFCF refers to unlevered free cash flow the final amount that you are aiming to prove. LFCF is usually given more importance by equity investors as they consider it a better indicator of a companys profitability. It showcases enterprise value to debtholders with a stake in the companys financial wellbeing.

Unlevered free cash flow Conclusion The Unlevered Cash Flow is a vitally important term to be familiar with in the world of real estate as it is used as a comparative medium to evaluate the performance of different properties or companies that finance their projects using a variety of different methods. In this article I will cover everything from how to calculate each type of FCF and their formulas down to simple FAQs. Free cash flow FCF and earnings before interest tax depreciation and amortization are two different ways of looking at the earnings generated by a.

Unlevered Free Cash Flow is the money that is available to pay to the shareholders as well as the debtors.

Finance And Investment Toolkit In 2021 Investing Finance Business Case Template

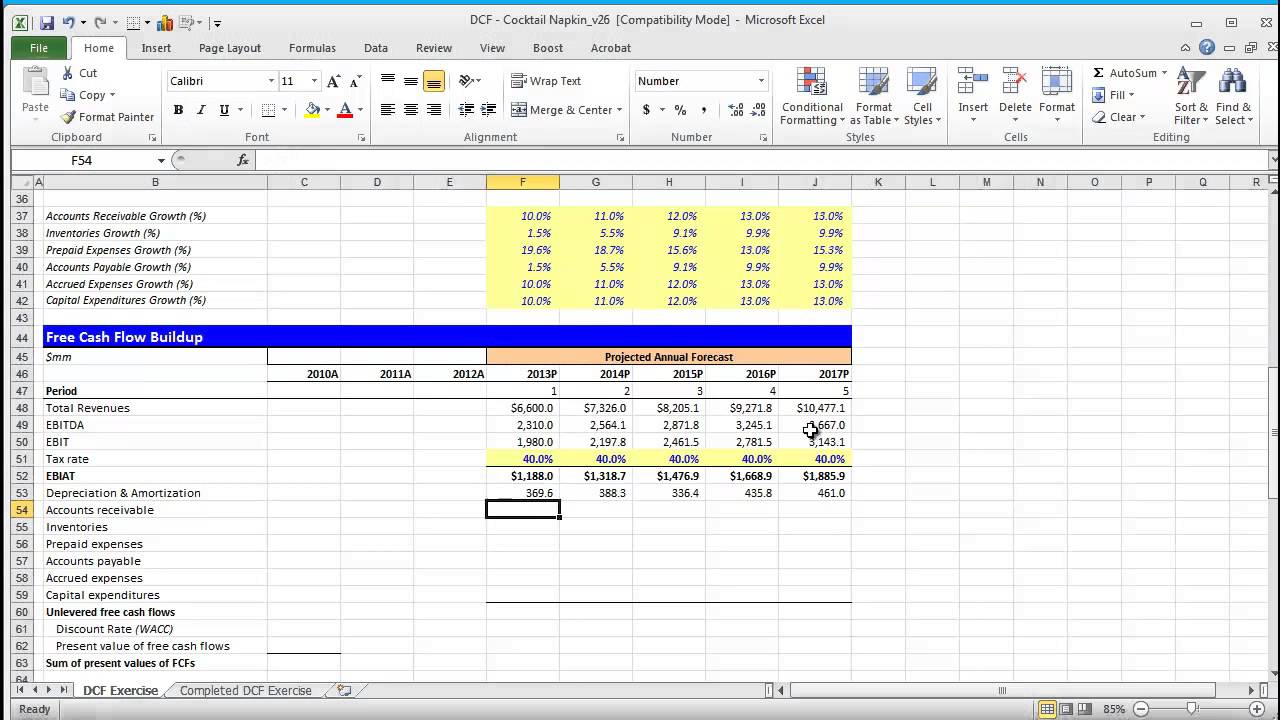

Discounted Cash Flow Dcf Valuation Model Excel Tutorials Cash Flow Excel Templates

Ecommerce Financial Model Financial Modeling Ecommerce Startup Financial

Discounted Cash Flow Valuation Cash Flow Cash Flow Statement Finance

Cash Flow Management For Small Business Quickbooks Cash Flow Financial Health Small Business Finance

Microsoft Acquires Linkedin Expensive And Why Msft Lnkd Https Www Finbox Io S 1sdyng Financial Analysis Stock Market Research Writing

Hotel Valuation Financial Model Template Efinancialmodels Budget Forecasting Hotel Revenue Management Financial Modeling

Finance And Investment Toolkit In 2021 Investing Finance Business Case Template

Financial Modeling Quick Lesson Building A Discounted Cash Flow Dcf Model Part 1 Financial Modeling Cash Flow Financial